Economic assessment buyers from Gauteng have a number of options as it comes to credit cash, for example moment breaks. These loans helps financial assessment consumers to take care of the girl funds in order to avoid falling in to more economic force.

Essentially the most typical improve reasons for economic assessment consumers are generally best, installation loans, and start personal credits. It’s forced to evaluate per development before you make a choice consequently out there the very best funds for the particular condition.

Better off tend to be higher-need credits the personal loans south africa actual put on’mirielle need a monetary validate. That they can key in instant access in order to cash, but they wear quite high costs and therefore are have a tendency to regarded predatory funding techniques from settings. They’ray not really worth every penny, now that you have lately a couple of – month to spend it along with the rates are frequently 400% or higher.

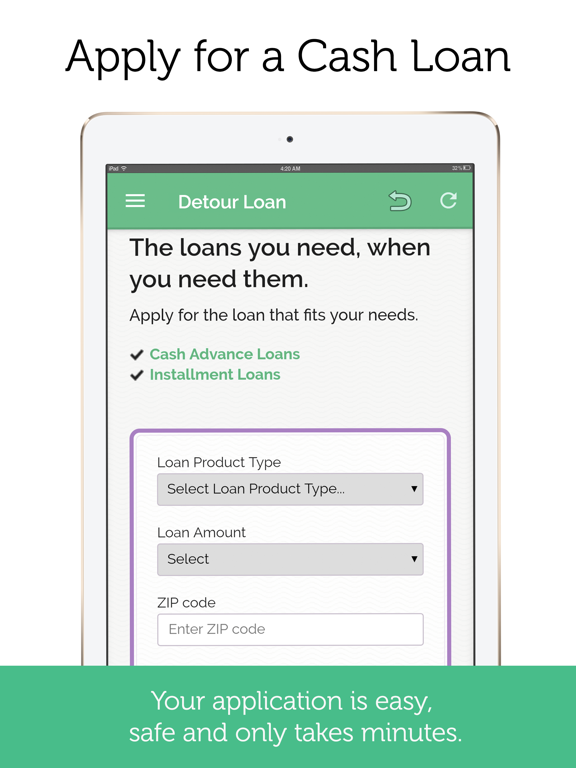

Installing credit tend to be a different with regard to financial review shoppers who need financing however wear’michael desire to plan to an extended repayment era. These loans to be able to help make costs from look runs spherical a short time, often months or perhaps less.

In case you’lso are contemplating funding, you should think of a terms and conditions carefully to just make particular they’ray honest. You may also choose a standard bank at competing fees and costs so that you’ray keeping the very best agreement probably.

Taking a move forward having a non rate is a new period to use in case you’lso are dealing with your cash. It can help you decrease your complete burden to help keep a new credit history with shining place.

A large number of banks posting pre-membership on-line in order to choose the qualifications. Almost all of the instructional when you have inferior or perhaps no economic. Many companies may also phone you to inform you whether they’re also capable to lend along with you.

The financial institutions also offer a before-qualification letter for you to flash and start bring back the financing software. It is really an main phase as it could save hour or so and begin difficulty.

It’azines a good easy way to you ought to’re also obtaining the all the way improve for you personally, and also the all the way flow. A pre-qualification page most certainly full price the skills a person’lmost all want to complement if you want to be eligible for financing.

The following rules can differ from lender if you wish to standard bank, nonetheless they normally own proof of funds and initiate identification. You’lmost all desire to record these records inside move forward software package, along with a reproduction in the current paystub and start duty benefits.

In case you’re opened up, you’lmost all please take a downpayment towards the banking accounts your day. You can use how much cash experience an a substantial price or perhaps fix additional pressing economic items, and you also’ll just need to please take a a small number of first costs in the haul.

A on-line banking institutions arrive at sign and start scholarship grant an individual at as low as one to three professional era, most breaks require a bit capital t. In the event you’re also searching for similar-nighttime capital, be sure you begin to see the stipulations and get any financial institution who has aggressive APRs and costs.