Contents:

Spread trading, like any other form of trading, carries a number of risks that traders and investors should be aware of. For example, market risk can affect the value of the underlying assets and the profitability of the spread trade. Thus, if a trader enters into a bull call spread on a stock that they believe will rise in price, but the stock’s price unexpectedly drops due to market conditions, the trader may suffer a loss on the spread trade. Likewise, if you bet that a spread will narrow but it widens, you can lose money.

The “TED Spread” The difference between the interest rates on Treasury Notes (T -Notes) and Eurodollar futures is called the TED spread. T-Note rates provide a measure of the U.S. government’s medium term borrowing costs. Rise during financial crisis to reflect uneven data problems that make it harder to gauge the riskiness of company borrowers. For example, a bond issued by a large, steady, and financially wholesome corporation will sometimes commerce at a relatively low unfold in relation to U.S. Conversely, a bond issued by a smaller firm with weaker financials will trade at a better unfold relative to Treasuries. As Mike mentioned, it seems like one of the larger issues with LIBOR, regardless of its role as in indicator, per se, is the fact that so many loans in the US are tied to LIBOR rates.

TED spread

The federal government doesn’t dictate short-term interest rates; it follows the corporate interest rates. The TED spread may be a key measure of risk and volatility in markets. While it’s generally known that no one can really time the stock market, investors may want to better understand the TED spread and how it has changed over time during periods of economic uncertainty. Term spreads, also known as interest rate spreads, represent the difference between the long-term interest rates and short-term interest rates on debt instruments such as bonds. In order to understand the significance of term spreads, we must first understand bonds.

The chart below looks back at 40 years of falling https://1investing.in/-term interest rates from 1982 to 2020. Right now, it seems like we are at the start of a 40-year cycle of rising corporate interest rates. In the past, the TED spread has climbed above 100 basis points, such as during the financial crisis of 2008, when it reached around 460 basis points, or in March 2020 when it approached 150 basis points.

What Is a Spread?

The TED spread is the difference between the three-month Treasury bill and the three-month LIBOR based in U.S. dollars. To put it another way, the TED spread is the difference between the interest rate on short-term U.S. government debt and the interest rate on interbank loans. The TED Spread measures the difference in basis points between the US LIBOR rate and the 3 Month US Treasury Rate.

Weekly Indicators: Several Long Leading Indicators Improve To … – Seeking Alpha

Weekly Indicators: Several Long Leading Indicators Improve To ….

Posted: Sat, 25 Feb 2023 13:00:00 GMT [source]

It represents the price of repeated overnight unsecured lending over durations of up to two weeks . Because it is based on in a single day lending, it is assumed to have a decrease credit score threat than long run interbank loans based mostly on say 1M, 2M or 3M Libor and that is what drivers the OIS-Libor spread. Three-month LIBOR is generally a floating rate of financing, which fluctuates depending on how risky a lending bank feels a couple of borrowing bank. The OIS is a swap derived from the in a single day price, which is mostly mounted by the native central financial institution.

What Is The TED Spread Telling Investors About The Credit Market?

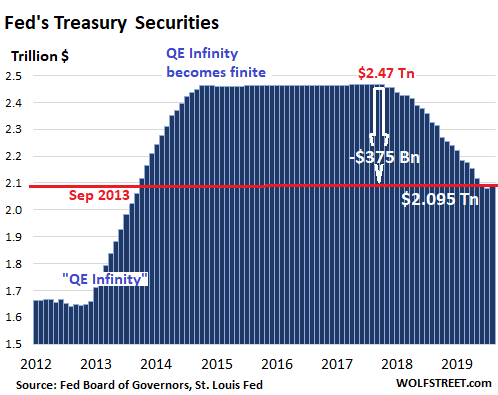

Since that peak, is has spent much of the past decade between 0.2% and 0.5%, peaking at 0.61% in March 2018. Last week, investors got their last update of 2019 from the Federal Reserve. While most investors focused on interest rates and dot plots, one Fed-related metric appears to be heading lower once again heading into 2020.

According to an announcement by the Federal Reserve on November 30, 2020, banks should stop writing contracts using LIBOR by the end of 2021. The Intercontinental Exchange, the authority responsible for LIBOR, will stop publishing one week and two month LIBOR after December 31, 2021. In October 2013, due to worries regarding a potential default on US debt, the 1-month TED went negative for the first time since tracking started. According to the observation from Fred Economic Data, the current value of TED Spread as of 21 January 2022 is 0.09%. It is derived by subtracting the three-month Treasury Bill interest rate from the three-month LIBOR interest rate based on U.S. dollars. Traders also use online base point calculators to arrive at the spread value in base point units.

The Federal Reserve is nothing more than a consortium of private companies. Big banks and investment firms like JP Morgan, Goldman Sachs, Bank of America, Wells Fargo, Citibank, and the Chicago Mercantile Exchange Group set the corporate interest rates. For example, if corporate interest rates go up in March, you’ll see the federal funds rate increase by April.

TED Spread – Historical Chart

List of principal searches undertaken by users to access our English online dictionary and most widely used expressions with the word «TED spread». The Fannie Mae 30-yr mortgage commitment for supply within 60 days helps mortgage lenders decide what charges to charge on 30-yr fastened fee mortgages which might be to be bought to Fannie Mae inside the next 60 days. TED Spread is at 0.09%, compared to 0.08% the previous market day and 0.13% last year.

It’s also worth exploring the complicating factors behind T-Bills and LIBOR. The LIBOR is a benchmark interest rate that reflects the cost of funds to large global banks operating in the London money market (the world’s largest money market). It represents the interest rate at which banks can borrow funds, in marketable size, from other banks in the London interbank market. Before the crisis, the spread was in the range between 20 to 60 basis points. Similarly, after the crisis in the year 2010, the spread came back to its long-term average of 30 basis points and even hit the low of 11 bps in March.

If the prime interest rate is 3%, for example, and a borrower gets a mortgage charging a 5% rate, the spread is 2%. As a general rule, a spread of less than 0.50 is seen as low, indicating that the financial markets perceive a small financial risk. On the other hand, a spread of over 1.0 suggests greater uncertainty and some amount of risk in the banking system globally. Initially, the TED spread was the difference between the 3-month Treasury bills and the 3-month Eurodollar contracts with the same expiration. TED is a combination of the “Treasuries” and “Eurodollars,” whose ticker symbol is ED.

Market Prices and Bond Valuation

On December 23, 1913, President Woodrow Wilson signed the Federal Reserve Act into law. From that day, bankers were free to dilute the value of the U.S. dollar by increasing its supply. With each penny that banks lend, they increase the amount of money in circulation—which means their loans are worth less than when they initially borrowed them. Since then, the value of the U.S. dollar has dropped exponentially.

Weekly Indicators: Holding Pattern With A Negative Bias – Seeking Alpha

Weekly Indicators: Holding Pattern With A Negative Bias.

Posted: Sat, 11 Feb 2023 08:00:00 GMT [source]

Bonds are fixed-income securities through which an investor essentially loans the bond issuer capital for a defined period of time in exchange for a promise to repay the original note amount plus interest. Owners of these bonds become debt holders or creditors of the issuing entity as entities issue bonds as a means of raising capital or financing a special project. The TED Spread is the difference between the 3 month T-bill rate and the 3 month London Inter Bank Offered Rate . It is important because it is an indicator of perceived economic risk, monetary liquidity, and perceived credit risk of the global financial banking system. The OIS allows LIBOR-based mostly banks to borrow at a hard and fast price of interest over the same period.

- T-bills are considered risk free and measure an ultra-safe bet—the U.S. government’s creditworthiness.

- The OIS is a swap derived from the in a single day price, which is mostly mounted by the native central financial institution.

- Credit RiskCredit risk is the probability of a loss owing to the borrower’s failure to repay the loan or meet debt obligations.

- TED (Treasury-EuroDollar rate) spread refers to the difference between the interest rate on three-month U.S.

The effective ted spread definition funds rate (a volume-weighted average of all the known U.S. trades on a given day) was 2.64% on Sept 15 and 2.80% on Sept 17, despite the Fed’s intention to keep these numbers around 2.0. Somebody who was worried about how these days were going to unfold may have quite rationally bid quite a bit to secure the funds early. Or perhaps the U.S. banks dropped out of the London market altogether. In any case, a one- or two-day spike in this overnight rate is not that big a deal, since even a few hundred basis points is not that much money on a one-day loan. Following that impressive but brief spike, overnight LIBOR is now back to 2.31%, a modest 31 basis points over the Fed’s target. One measure that is being used to summarize the strain in financial markets is the TED spread.

This morning a couple more major institutions are gone and a watered down bailout goes to a vote – a baliout that might have been adequate over a week ago when it was desperately proposed but now even more buildings are on fire. DisclaimerAll content on this website, including dictionary, thesaurus, literature, geography, and other reference data is for informational purposes only. This information should not be considered complete, up to date, and is not intended to be used in place of a visit, consultation, or advice of a legal, medical, or any other professional. Here are all the possible meanings and translations of the word TED spread. The spread of the holy gospel and uninterrupted preaching went on until the return of the ambassador.